UGC funding for the UGC-funded institutions is

composed of recurrent

grants and capital

grants.

Recurrent grants support

institutions' academic

work and related administrative activities; and capital grants are

used to finance major works projects and minor campus improvement

works.

(A) Recurrent Grants

The recurrent funding for the 2009/10 to 2011/12

triennium was approved by the Finance Committee of the Legislative

Council in January 2009. The total approved recurrent funding for the

UGC-funded sector in the triennium amounts to $33,992 million. This

recurrent funding covers block grants and earmarked grants.

The bulk of the recurrent grants are disbursed to

institutions normally on a triennial basis to tie in with the academic

planning cycle, and in the form of a block grant, to provide

institutions with maximum flexibility. Once allocations are approved,

institutions have a high degree of freedom in deciding on how the

resources available are put to best use. Determination of the grants

to institutions is largely based on an established formula. The amount

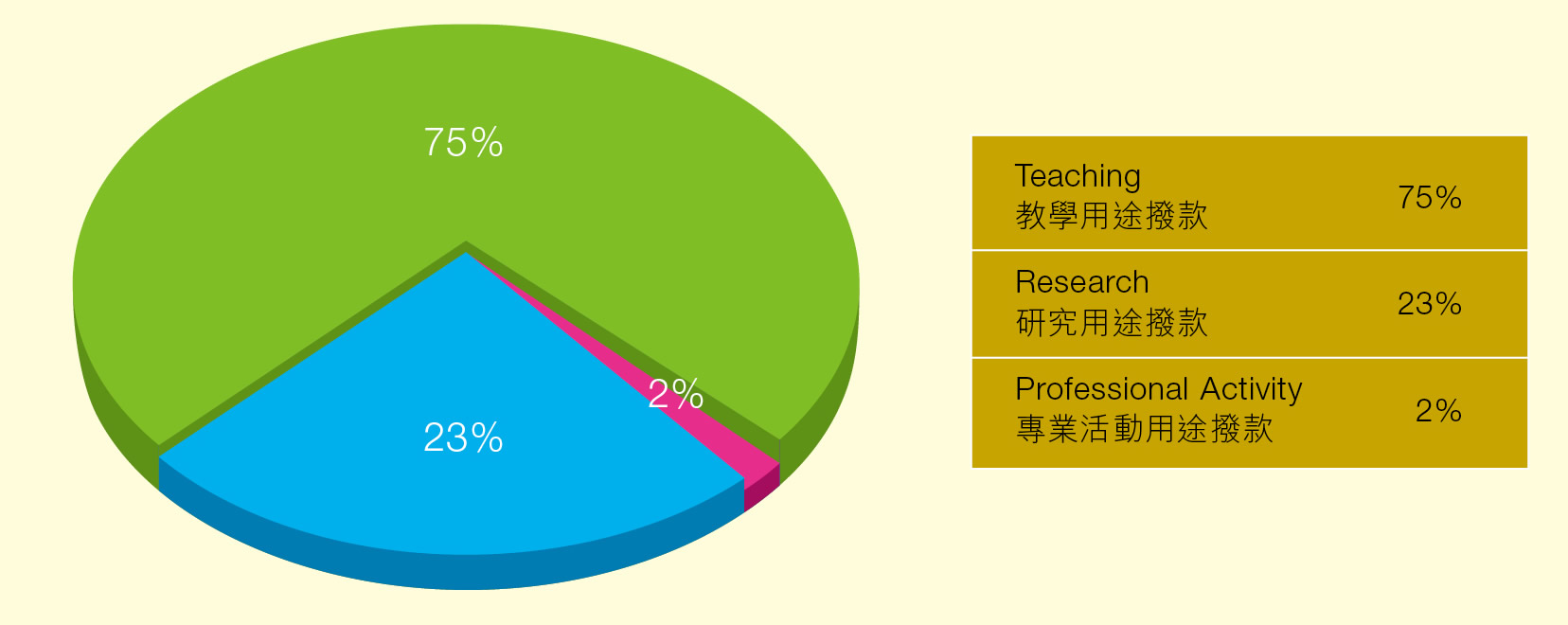

of block grants comprises three elements:

|

|

|

Teaching

The

Teaching element is based on student numbers, their levels (i.e.

sub-degree, undergraduate, taught postgraduate and research

postgraduate), mode of study (i.e. part-time and full-time) and

disciplines of study. Some subjects are more expensive than

others because they require special equipment, laboratories,

more staff time, etc. Relative cost weightings by broad academic

programme categories (APCs) have been grouped into three price

groups with effect from the 2005/06 to 2007/08 triennium.

Details are shown at Chart 1. |

|

Research

The

Research element is primarily related to the quality and number

of active research staff and the cost of research in respective

fields. The number of active research staff in each cost centre

is identified in the context of a Research Assessment Exercise

which assesses the research performance of different cost

centres within institutions.

|

|

Professional

Activity

The

Professional Activity element is associated with professional

activities which the Research Assessment Exercise is unable to

assess or to assess adequately, but should be undertaken by all

members of academic staff. These include, for example, community

service undertaken and advice rendered on societal or

professional issues. It is calculated based on the number of

academic staff.

|

|

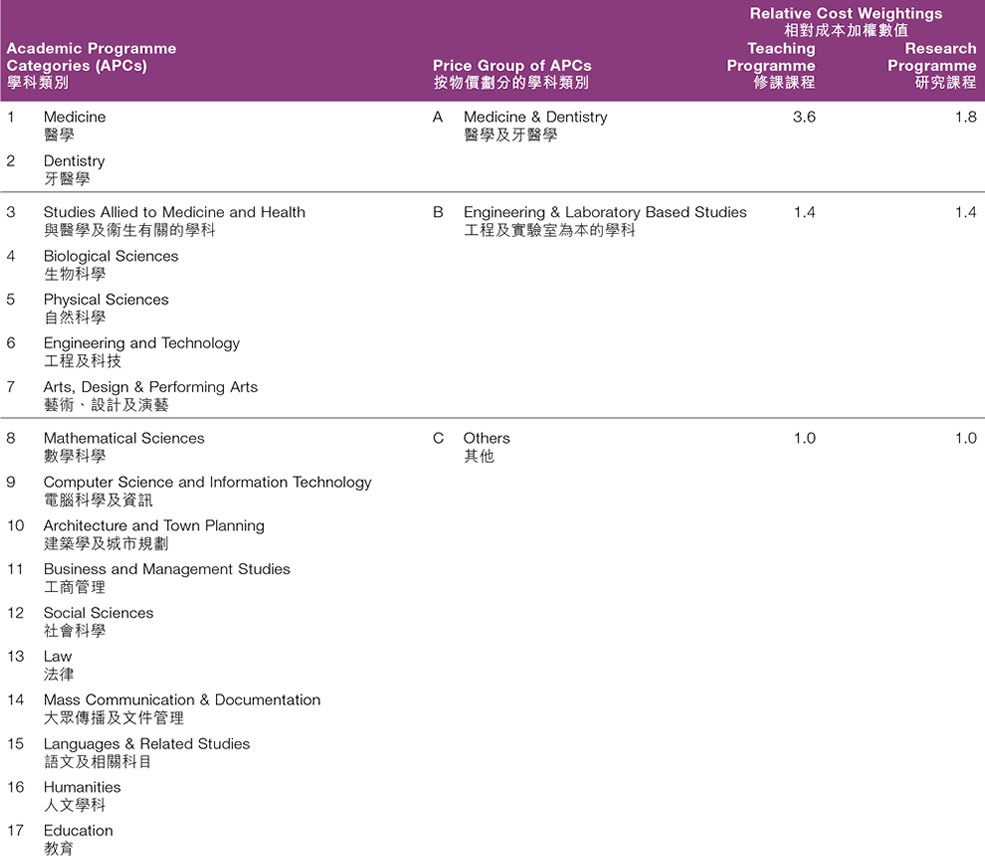

Chart 1:

Relative Cost Weightings by Price Groups of Academic Programme

Categories

|

|

The

funding formula is the key parameter used to assess institutions'

needs. But in finalising its funding recommendations, the UGC also

takes into account the special needs of individual institutions and

other factors not captured by the formula and will introduce

extra-formulaic adjustments where required.

Earmarked grants for specific

purposes are allocations outside the block grant system. Examples are

the earmarked research grants, grants for knowledge transfer

activities, grants for areas of excellence scheme and central

allocation vote project grants.

Once determined, recurrent funding

for a triennium will not be adjusted during the period except for

adjustments to take into account changes in the indicative tuition fee

levels, new initiatives from the Government and civil service pay

adjustments. Following the civil service pay cut which took effect

from 1 January 2010, the subvention for 2009/10 was reduced by

approximately $165 million.

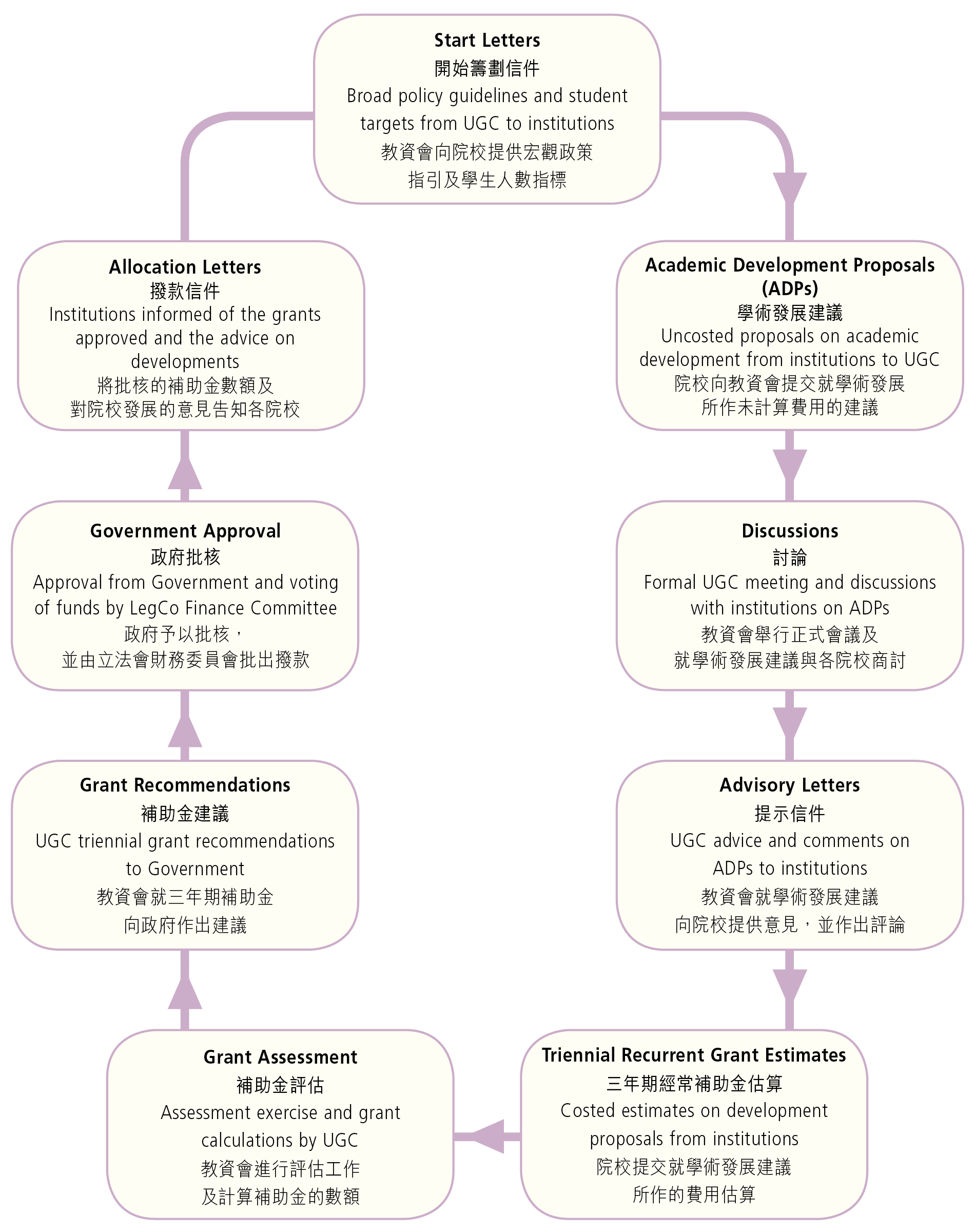

Diagrammatic Illustration

of UGC Recurrent Grant Cycle |

|

|

Financial Reporting

and Monitoring

The UGC-funded institutions are autonomous statutory bodies governed by

their respective Ordinances. They enjoy considerable institutional

autonomy in such areas as curriculum design, selection and recruitment

of staff and students, and internal allocation of finances. While

respecting the institutional autonomy of our funded institutions in

allocating and managing their internal finances, the UGC adopts an

accountable and transparent approach in ensuring the public money

entrusted to the institutions are applied meaningfully and of value

for money.

To

provide institutions with substantial financial freedom, the bulk of

the subvention to institutions are chiefly in the form of the block

grant, which provides for a "one-line" allocation of resources

for a funding period (usually a triennium) without prescription

attached as to how it should be spent. The major requirement is that

such grant must be applied within the ambit of "UGC-fundable

activities" while adhering to approved student number targets. The

precise amount of the block grant has to be approved by the Finance

Committee of the Legislative Council before the start of every

triennial funding period, after which it is squarely upon the

institutions to take charge of the responsibility to apply those funds

appropriately.

Institutions are accountable for any

unspent balances of the public funds

While

being entitled to maintain a general reserve of up to 20% of the

institution's total approved recurrent grants (excluding any

earmarked grants) in a triennium for future and new development needs,

any excess of that level has to be returned to the UGC. The use of the

general reserve is subject to the same rules and regulations governing

the use of recurrent grants. For grants earmarked for specific

purposes, any amount unspent after the close of financial year or

approved funding period must be returned.

Institutions provide regular reports

on their finances to the UGC

We

require institutions to submit for each financial year an annual

return on the use of all UGC funds. We also require Heads of

Institutions to provide a Certificate of Accountability to the UGC

annually to confirm that the public funds allocated via the UGC had

been spent in accordance with the rules and guidelines as agreed with

the UGC.

Institutional finances are subject

to professional accounting standards and external audit processes

Institutions

are required to keep proper accounting records in accordance with the

Hong Kong Financial Reporting Standards and the house guidelines on

recommended accounting practice adopted by the UGC where appropriate.

Institutions also arrange their own external annual audits on their

financial statements and the annual return, in accordance with

prevalent assurance engagement standards adopted by the audit

profession. For the purpose of efficient use of public funds,

institutions are also subject to examination by the Director of Audit.

From

time to time, the UGC may express interest in the financial well-being

of UGC-funded institutions and enquire on specific financial issues

concerning the UGC sector.

(B) Capital

Grants

The

UGC supports capital works projects of institutions for UGC-approved

activities by capital grants which are sought from the Government on

an annual basis under the Capital Programme and the Alterations,

Additions, Repairs and Improvements (AA&I) Programme. Details are

at the chapter "Activities Review - Capital Works".

Financial Reporting

and Monitoring

The

capital grants are charged to the Capital Works Reserve Fund and are

part of the Capital Works Programme (CWP) of the Government.

Institutions' projects under capital subvention are required to

follow the procedures for creating and managing a capital works

project under the CWP. Institutions assume full responsibility and

accountability for their projects under capital subvention. They

should ensure that works expenditure stays strictly within the

approved project estimate in accordance with the approved project

scope i.e. the scope approved by the Legislative Council for capital

works projects exceeding $21 million, and the scope approved by the

UGC for AA&I projects up to $21 million.

Institutions

should ensure that an appropriate system of cost control and

monitoring is in place for overseeing the spending of public money

having regard to economy, efficiency and effectiveness in the delivery

of their projects under capital subvention and use of public funds. In

particular, institutions should ensure proper procurement procedures

are in place for purchases under capital subvention with reference to

Government's latest rules and regulations applicable to public

capital works.

Approved

funds for the projects are released to the institutions on a monthly

basis. Upon completion of a project, the institution should submit a

statement of final accounts to the UGC and return any unspent balance

or unapproved expenditure to the Government.

|